Estimate how much you can borrow for a mortgage

This percentage is the interest rate. The bigger your deposit the smaller your loan will be and the less interest youll have to pay.

Ssjtafrpq7xz M

Before you can obtain a mortgage you must undergo a qualification process.

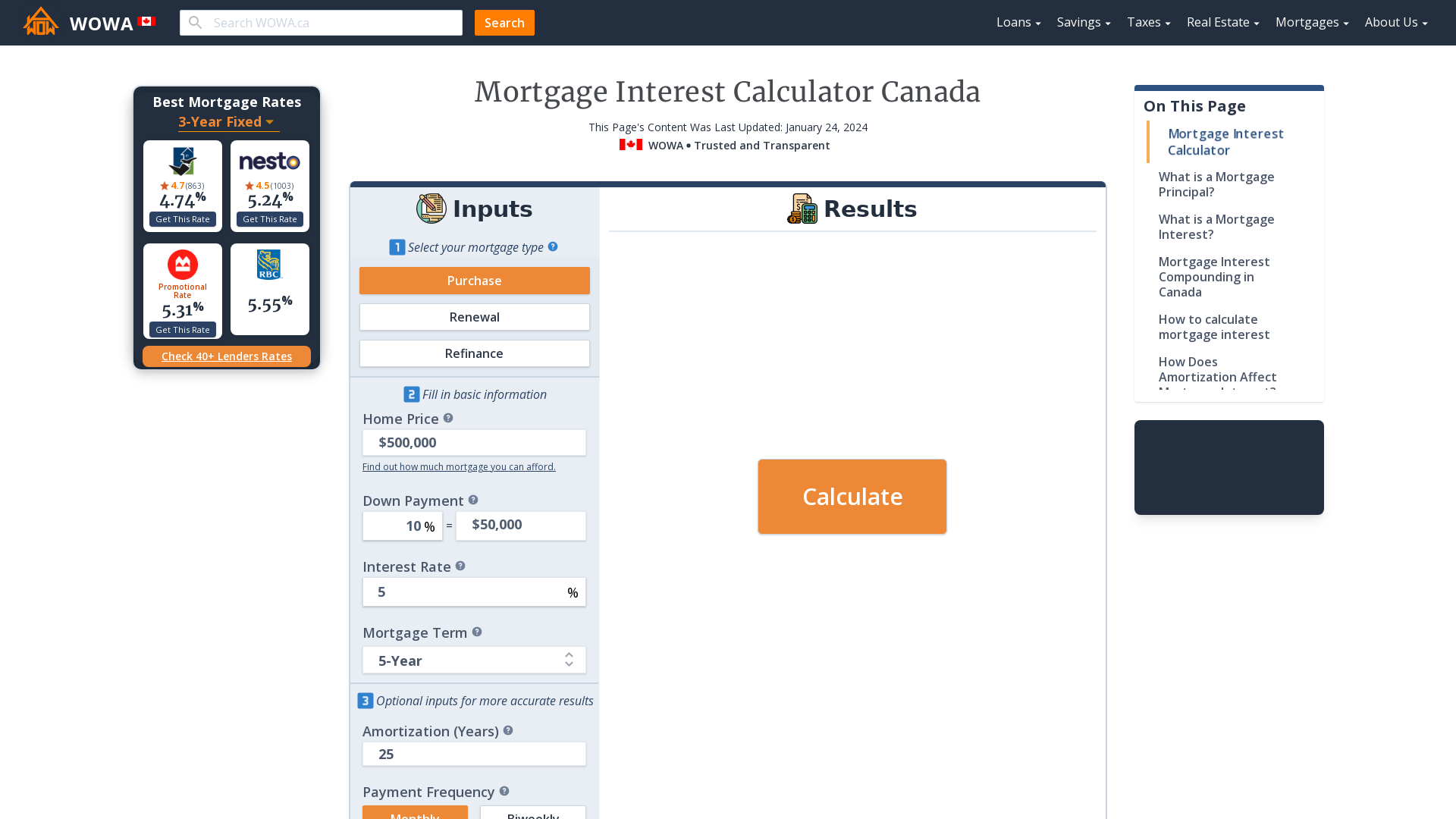

. Enter some basic information to get started. Just enter your income debts and some other information to get NerdWallets recommendation for how big a mortgage. Our mortgage calculator can help you estimate your monthly mortgage payment.

The more you borrow from your bank the more interest youll need to repay. Mortgage programs which require a minimal down payment. Lets presume you and your spouse have a combined total annual salary of 102200.

This provides a ballpark estimate of the required minimum income to afford a home. Total subsidized and unsubsidized loan limits over the course of your entire education include. If you have a variable interest rate paying attention to the federal funds rate can help you predict what your interest rate will do.

Although this can include a range of costs from grocery bills to streaming services some of the largest expenses include auto payments credit card payments and utilities. Well estimate how much the improvement could save you in the long run. Ideally you should save as much as possible before buying a home.

The outstanding loan amount. To understand how this works lets take the example below. It also gives you an overall picture of whether you satisfy minimum requirements for a mortgage.

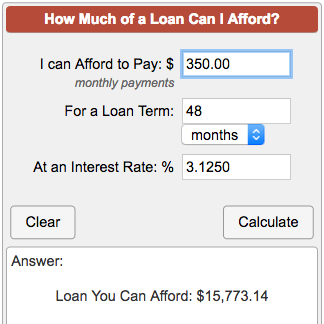

Its a good indicator of whether you satisfy minimum. Calculator can give you an estimate of the loan amount. How much can I borrow.

Our How Much Can I Borrow. You can also input your spouses income if you intend to obtain a joint application for the mortgage. A mortgage would allow you to make that 30000 payment while a lender gives.

How much house can I afford. The mortgage pre-qualifying process is an informal assessment of your ability to repay a loan. 31000 23000 subsidized 7000 unsubsidized Independent.

The amount you can borrow for your mortgage depends on a number of factors these include. Your income expenses and deposit are the biggest factors determining your borrowing power but lenders also consider other factors such as your existing debts and if you are using a guarantor for the loan. For example 5 of 1 million will always be a larger amount than 5 of 500000.

Just by entering your homes value into the websites friendly interface youll get a Zestimate a Zillow-created estimate of your homes. Using a percentage of your income can help determine how much house you can afford. Halifax Conveyancing Service.

Most low-down mortgages require a down payment of between 3 - 5 of the property value. Before applying for a mortgage you can use our calculator above. Find out how much you can afford to borrow with NerdWallets mortgage calculator.

For example you probably cant pay 400000 for a home upfront however maybe you can afford to pay 30000 upfront. The interest you pay is based on a percentage of the remaining loan amount. Your salary bill payments any additional outgoing payments including examples such as student loans or credit card bills.

However some lenders have. You can use the above calculator to estimate how much you can borrow based on your salary. The minimum required deposit is 10 but aim for 20 if possible.

This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income and your. The typical monthly student loan payment among borrowers who were actively repaying their loans in 2019 was between 200 and 299 according to the Federal Reserve. Use our borrowing calculator to work out how much you could borrow for a home loan to buy a house and what your home loan repayments might be.

For example the 2836 rule may help you decide how much to spend on a home. Home Energy Saving Tool. Interest is the fee you pay to your mortgage company to borrow the money.

2000 cashback when you refinance to us If youre eligible and you apply to move your home loan to us by 28 February 2023 you could get less home load with 2000 cashback. One financial advisor I spoke to Joseph Carbone says the best part about Zillow is the layout of the site and how easy it is to use. If you have no deposit and need to borrow the full amount otherwise known as needing a 100 LTV - mortgage you can still get a loan but your options will be much more limited than if you had a.

The amount you borrow. This provides you a ballpark estimate of how much you can borrow from a lender. But your monthly bill may be.

Zillow is one of the biggest and most popular websites for monitoring your homes value. This can have an impact on how much money you have to commit to your monthly mortgage payments ultimately affecting how much house you can afford. Our borrowing power calculator asks you to enter details including your loan term and interest rate income and expenses and any outstanding debts.

This provides a rough estimate of how much you can borrow for a loan. The rule states that your mortgage should be no more than 28 percent of your total monthly gross income and no more than 36 percent of your total debt. While you may have heard of using the 2836 rule to calculate affordability the correct DTI ratio that lenders will use to assess how much house you can afford is 3643.

Home Building Cost Estimate Spreadsheet Laobing Kaisuo Building Costs Building A House Cost Home Construction Cost

How Much Loan Can I Afford

Pin By Colleen Marcinkiewicz On Useful How To Plan The Borrowers Mortgage Calculator

Appraisals Are The Key To Knowing How Much Money You Can Borrow For Your Home And What It S Worth A Licensed Mortgage Lenders Real Estate Terms The Borrowers

Decoding The Factors That Determine Your Credit Score Infographic Daily Infographic Credit Score Infographic Credit Repair Credit Card Infographic

How Much Can You Save By Paying Off Your Mortgage Earlynever Realized That Pa Payoff Mortgage Paying O Pay Off Mortgage Early Mortgage Payoff Mortgage Tips

The Loan Vs The Line Of Credit Home Equity Loans Home Equity Loan Home Equity Home Improvement Loans

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Mortgage Calculator How Much Can I Afford Mortgage Calculator Mortgage Mortgage Payment

How Many Times My Salary Can I Borrow For A Mortgage Canadian Real Estate Wealth

Use The Interactive Home Loan Calculator To Calculate Your Home Loan Emi Mortgage Amortization Calculator Mortgage Loan Originator Mortgage Payment Calculator

Buying A House Estimate How Much You May Be Able To Borrow With Today S Mortgage Rates And Refinance Rates Use Our Wells Fargo Mortgage Rate And Paymen Natural

Feeling That Homeowner Fomo Here Are Some Tips On How To Get Started With The Home Buying Process Home Buying Process Home Buying Home Financing

Use Our Mortgagecalculator To Help You Set Your Budget Price Your Payments See How Making Additional Paym Home Buying Tips Mortgage Calculator Calculators

Use This Calculator To Generate An Amortization Schedule For Your Current Mortga Amortization Pr Interest Calculator Mortgage Refinance Calculator Calculator

A Dummies Graphical How To Guide To Getting A Home Loan Home Buying Process Home Improvement Loans Home Mortgage

Key Players In The Home Buying Process Realestate Home Buying Process Home Buying The Borrowers