Reinvestment rate formula

Start Growing Your Savings With Research Tools Provided By These Top-Reviewed Brokerages. Reinvestment rate refers to the rate at which cash flows from an investment can be reinvested into another.

Retention Ratio How To Calculate It With Examples

A casinos player reinvestment rate on a monthly basis.

:max_bytes(150000):strip_icc()/NPVFormula-5c23ea8f46e0fb00013d2624.jpg)

. Ad These Top Brokerages Offer Tools For New Investors And Those With Years Of Experience. This is illustrated in Table 1. Here this step helps you to choose how much money you want to invest in a stock.

The formula for the cash reinvestment ratio is. Add the Money invested. Visit The Official Edward Jones Site.

An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. The formula assumes a reinvestment rate of 15 percent which is highly unlikely. The equation used to calculate the reinvestment rate is as follows.

It is also the amount of interest that an investor can earn when the. The MIRR formula used by firms and investors in capital budgeting is as follows. Increase in fixed assets Increase in working capital Net income Noncash expenses Noncash sales -.

Reinvestment Rate Net CapEx Change in NWC NOPAT Lets define these terms. Cash Flows Individual cash flows from each period in the series Financing Rate Cost of borrowing or. Where FVCF Future cost of the positive cash flows after deducting the reinvestment rate or cost of capital.

It can be calculated using the following formula. Cash reinvestment is a term used to describe the change in retained earnings over a certain period of time. With a Focus on Client Goals American Funds Takes a Different Approach to Investing.

Here are a few major steps to use the Dividend Reinvestment Calculator. Divide the companys capital expenditures by the net income to determine the reinvestment rate. New Look At Your Financial Strategy.

The financial management rate-of-return formula still assumes Ryan will reinvest the entire 300 per month. Equity reinvested in business Capital Expenditures Depreciation Change in Working Capital New Debt Issued Debt Repaid Dividing this number by the net income gives us a much. Formula The equation for the cash reinvestment ratio is as follows.

Experimentation to Find the Right Reinvestment Rate Once the data has been collected and. Ad Actionable Investing Ideas and Trends You Can Use to Help Clients Pursue Their Goals. For a more real-world example consider a Company XYZ bond with a 10 yield to maturity.

If he chooses to invest it in a CD that pays 4 then his reinvestment rate is 4. For example if a company has 100000 in net. Cash Reinvestment Ratio Increase in Fixed Assets Increase in Working Capital Net Income.

MIRR cash flows financing rate reinvestment rate Where. Brought to you by Sapling.

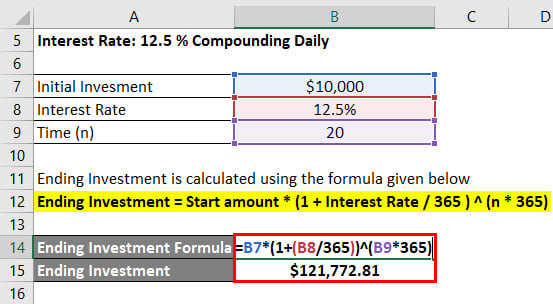

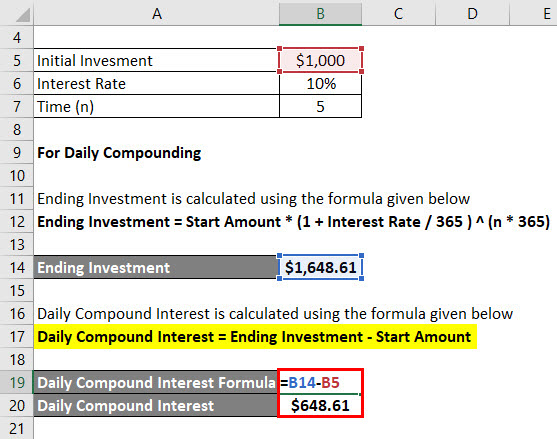

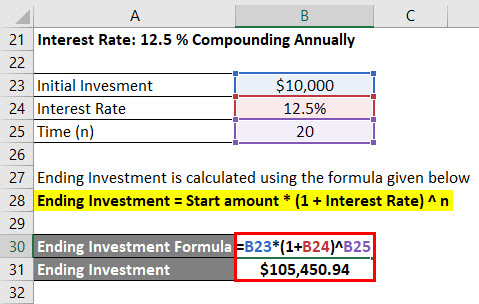

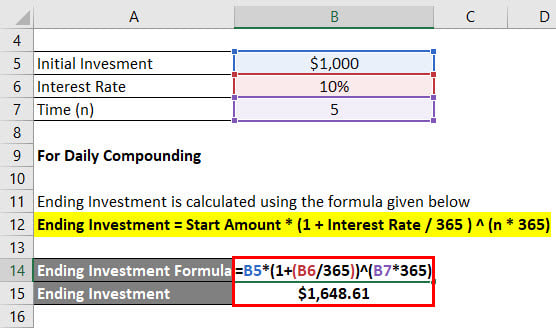

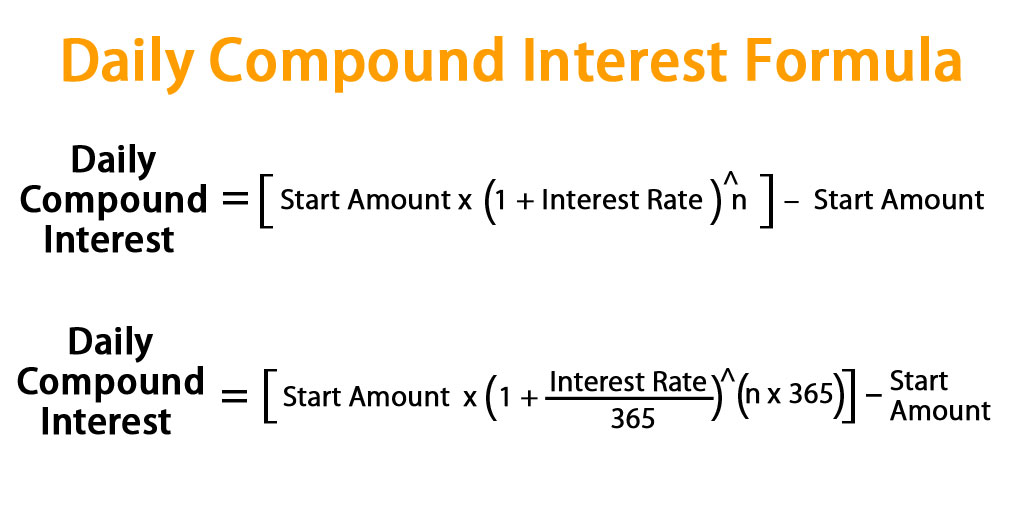

Daily Compound Interest Formula Calculator Excel Template

How To Use Mirr Function In Google Sheets 2020 Sheetaki

:max_bytes(150000):strip_icc()/NPVFormula-5c23ea8f46e0fb00013d2624.jpg)

Net Present Value Vs Internal Rate Of Return

Year Over Year Yoy Growth Formula And Excel Calculator

Daily Compound Interest Formula Calculator Excel Template

Daily Compound Interest Formula Calculator Excel Template

Excel Discount Rate Formula Calculation And Examples

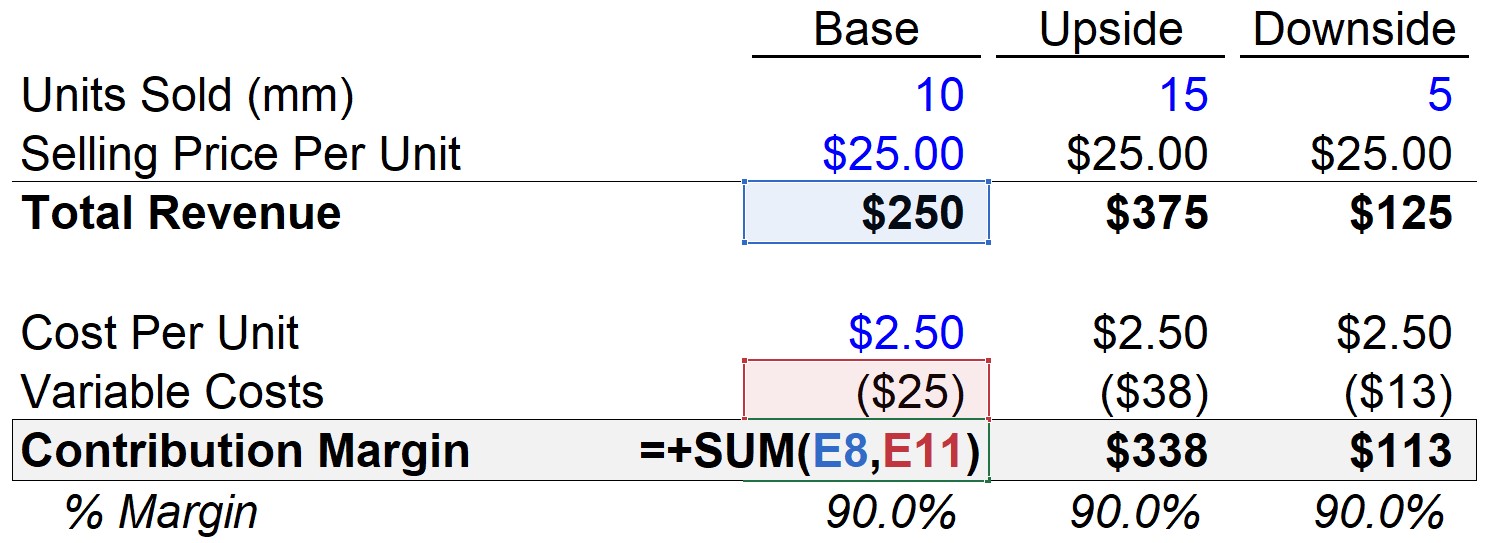

Operating Leverage Formula And Calculator Excel Template

Daily Compound Interest Formula Calculator Excel Template

Cash Turnover Formula And Ratio Calculator Excel Template

Days Inventory Outstanding Dio Formula And Excel Calculator

Receivables Turnover Formula And Calculator Excel Template

Excel Discount Rate Formula Calculation And Examples

Excel Discount Rate Formula Calculation And Examples

Inconsistent Results Caused By An Inappropriate Order Of Assumptions Download Scientific Diagram

Market Share Formula And Percentage Calculator Excel Template

Daily Compound Interest Formula Calculator Excel Template